CSotD: I won’t ask, I won’t ask, I won’t ask …

Skip to commentsWhat the hell were you thinking?

Oh, wait. I wasn’t going to ask that. It’s never helpful and it assumes a fact not in evidence.

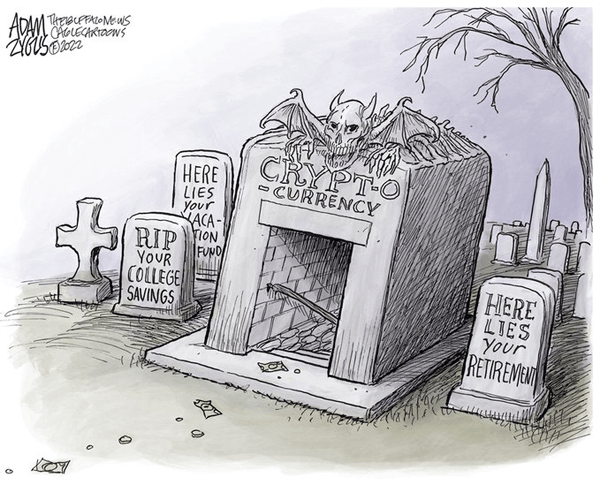

It’s also redundant, considering that the people who — as Adam Zyglis puts it — dumped their college savings, vacation money and retirement nest egg down the crypto rat hole are already asking the question, and probably not reveling in the answer. And, if they are married, I’m sure the circular firing squad is being assembled: Even if they agreed to do it, someone had the idea first.

I assume that the people we’re seeing interviewed who pitched in all they had and lost the farm, are a minority of those impacted. I won’t ask what the hell they were thinking, but I won’t use the word “victim” either.

I spent half an hour on the phone yesterday successfully demanding a $78.99 refund from a company with a no-refunds policy, so, yes, I would feel pretty bad if I’d pitched, not my life savings, but, say, five or ten grand into a deal where there can be no refunds because the money no longer exists.

Whether it’s $78.99 or 10 grand, it’s not the money. It’s the feeling of having been had.

It’s the agenbite of inwit that continually asks, “What the hell was I thinking?”

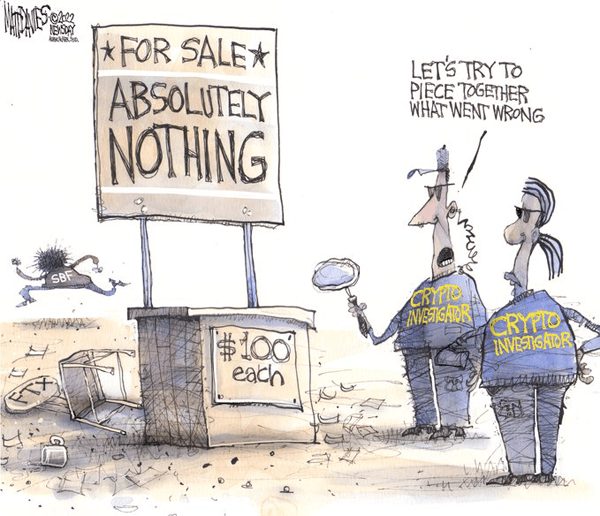

Matt Davies doesn’t help by pointing out that it was a damned silly investment in the first place, the suggestion here being that the question isn’t “How could this have happened?” so much as “How could this have not happened?”

A major factor is that instinctive desire to be one-up on everyone else, such that, when people were comparing crypto to Beanie Babies and baseball cards, it felt good to be smarter than them, to recognize the cunning plan that they were all too blind to see.

And, BTW, it’s easy enough to wish you’d bought IBM stock when it first went on the market, but does anyone wish they’d bought stock in Enron?

Dumb luck giveth and dumb luck taketh away.

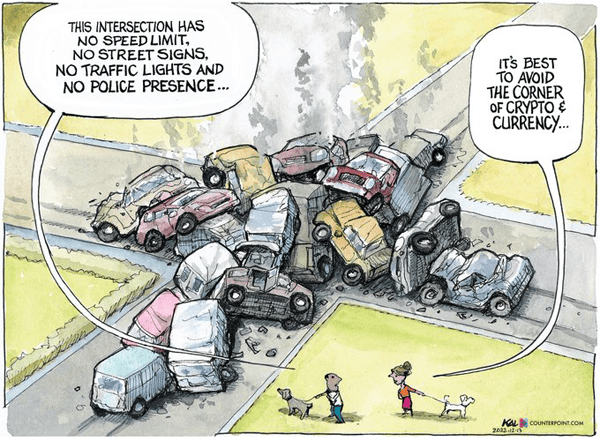

Kal Kallaugher (Counterpoint) offers a bit of analysis, which is that we have rules for a reason, which seems obvious in retrospect, as so many things do, but I would point out that it was obvious at the time as well.

One of the selling points was that crypto wasn’t hemmed in and restricted by government oversight and regulations, which seemed like a real benefit to some people and a whole lot of red flags to the fuddy-duddies.

I’d like to see the Venn diagram of people who thought letting crypto regulate itself was a good idea and the people who blame Joe Biden for inflation, because I suspect a fair amount of overlap and shame on them.

If you want regulation, say so. If you prefer chaos, say that. But you can’t want both. It makes no sense.

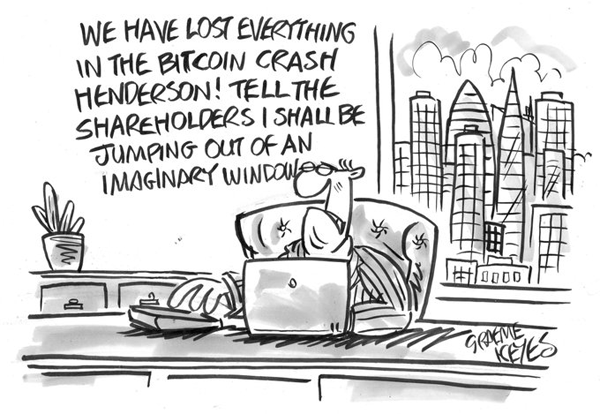

Though Graeme Keyes offers this consolation: Those who perpetrated this disaster will pay for it, except for the 98% who don’t wind up in jail, who will, instead, be hired by major corporations to do more or less the same thing to another flock of pigeons.

But I’ll bet they demand their new, exorbitant salaries be paid in real, tangible, government-regulated cash money.

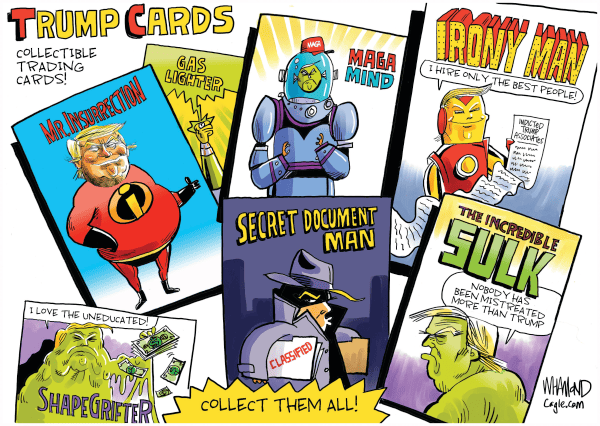

Speaking of pigeons, Donald Trump’s latest venture into pigeon-plucking inspired this cartoon by Dave Whamond, together with a whole lot of non-commercial graphic responses.

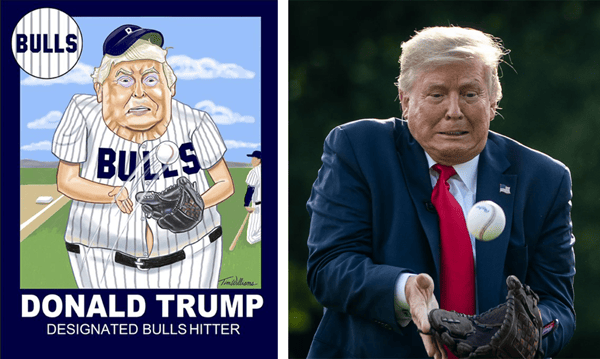

And Tim Williams posted a baseball card based on a particularly unflattering photo of Trump trying to catch a ball. Trump was apparently a fair-to-middling ballplayer in high school, but embellished his reputation with a claim that he had turned down a Major League career in order to go to college. Where he claimed to graduate with honors that were not noted in the commencement program. Also, his athletic claims fell apart with only a small amount of journalistic prodding.

Though you’d never know it from his manly, preening, muscular cards. As Mrs. Betty Bowers noted, “When you buy Donald Trump digital trading cards, you lose over 99 dollars—and he loses over 99 pounds.”

But this time, he’s serious: These pretend cards are really, really valuable!

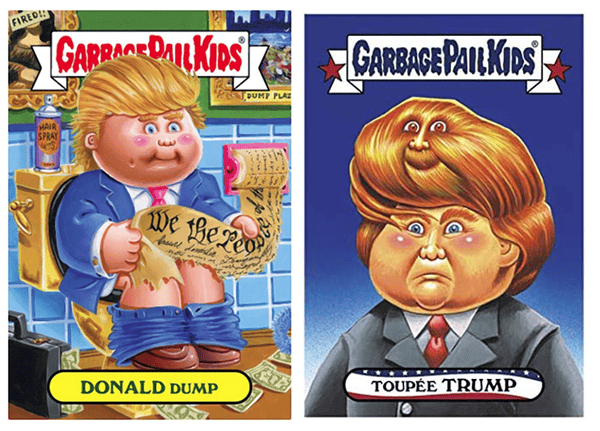

I don’t know the source (sources?) of these mock-ups which appeared on Twitter, but they’re better than the real ones. (Update: The one on the left, at least, is by Hsiao Wen Teng.)

Though nothing is better than this video. You know, kids, back before the Internet, you had to stay up for the all-night movies on TV to see commercials like this:

I do note that he’s accepting crypto, so you can use money that doesn’t really exist to purchase a digital trading card that doesn’t really exist.

There is, however, a serious side to all this, which is that Trump has been ripping off his supporters for some far larger stakes.

He’s a grifter and a con artist, and damn good at it. There are some legal walls closing in on him, but, whether he wriggles out or not, it’s not going to get your dear old granny’s money back for her.

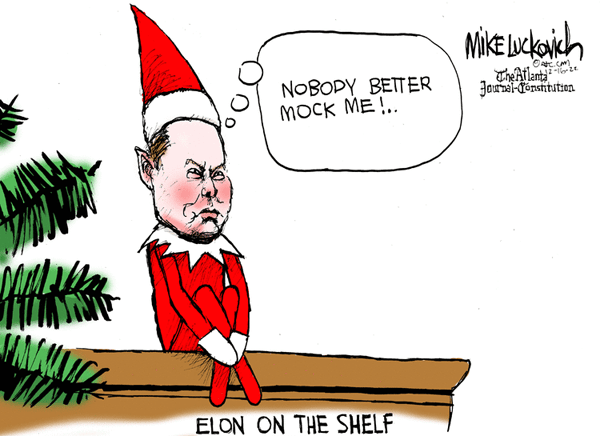

And speaking of grifters and the fools who follow them, Mike Luckovich well-captures the judgmental tattletale who is preaching a gospel of “Free Speech For My Allies, But Not For My Critics.”

After re-admitting a flood of neo-nazis, white supremacists and toxic liars back onto Twitter, Musk began kicking off liberal voices, which was known but only partially verified, until he suddenly dropped the hammer on some specific journalists for the sin of reporting that he’d blocked an account that followed his private jet. Reliable Sources has some responses from news organizations.

Musk was incensed by a Twitter account that offered updates on his private jet’s flights. He shut down that account, then threw together an anti-doxxing Twitter rule to justify his action but which is so full of exceptions and empty exclamations as to be useless: It’s basically a rule that says Elon can ban whoever he wants, anytime.

Ironically, the rule would exempt the account that started the whole imbroglio, given that flight information is publicly available and accessible. We’ve got someone at the dog park who, when a helicopter goes overhead, checks her phone and tells us who it is, where they came from and where they’re headed.

But nice try, BenElon Muskolini.

Comments 17

Comments are closed.