CSotD: News, weather and sports

Skip to comments

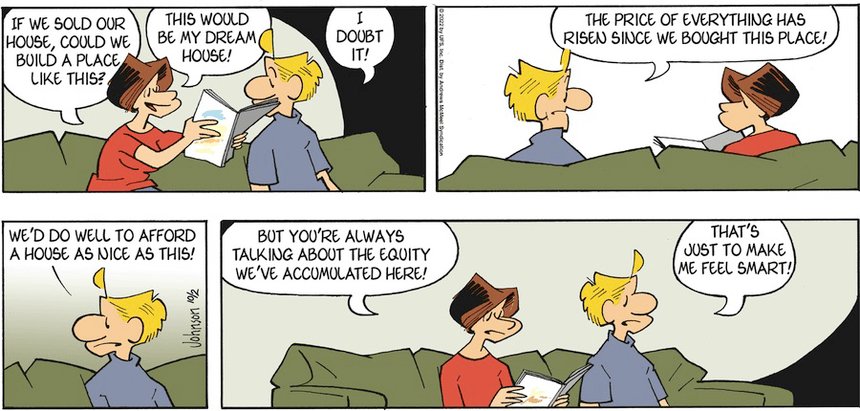

Arlo and Janis offer incisive commentary on the owner-side of the housing boom and how little it should matter to those who are already in a house, particularly one with a locked-in low-interest 30-year mortgage.

This is an excellent time for them to stay put and do nothing.

As he notes, they’d be unlikely to swap into a better place, not just because of higher prices but because, by the time they fixed their house up to sell and then paid the various closing costs, commissions and moving costs, they’d have to take a major step down the ladder.

And keep your hands off that equity, because there’s a lot of pixie dust in it, and, should you borrow against it and then see the bubble burst, you could find yourself upside down, with a debt greater than the recalibrated market value of your house.

Here’s an early Halloween horror story:

Back in the 80s, when I was writing for a real estate magazine in Colorado Springs, mortgage rates climbed into double digits, and lenders began offering what they called a 3-2-1 buydown, which meant that, for the first year, your payments were calculated at 3 points lower than the actual rate on your mortgage. The next year, it would be 2 percent lower, then 1 percent, and, in the fourth year, payments would be at the actual rate.

Later, as mortgage rates continued to rise, they switched to a 5-3-1 buydown, which sounded good, though, of course, the actual cost of those discounts was baked into the purchase price.

Which was popular in a military town, because, wotthehell, in three years you’d have a new assignment anyway, so you could sell your place and move on.

Except that the town was overbuilt, so that, when you tried to sell your condo, there were brand new unsold units at the other end of the building, and, thanks to all those discounted payments, you were underwater in your existing loan.

People had no choice but to trash their credit and walk away, and the HUD Repo listings went from magazine to phone book size.

We’re not there yet, but you can see it from here.

Listen to Arlo. Hunker down and stay put.

Juxtaposition of the Day

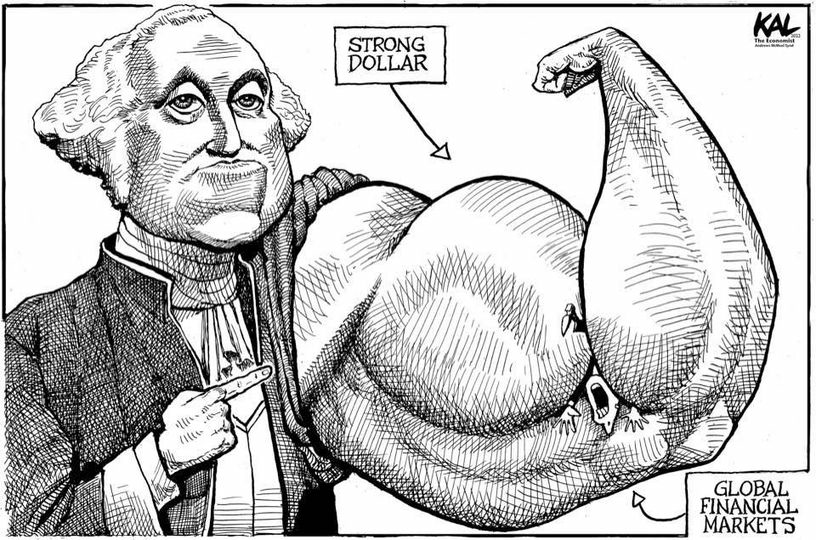

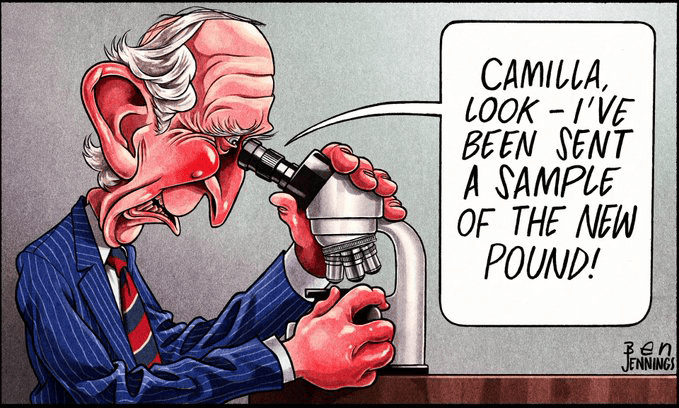

This is something of a good news/bad news thing, because, while we should probably be happy that the dollar is doing well, its strength, as Kal notes in a cartoon for the British magazine, the Economist, comes at the expense of world markets, as demonstrated by Ben Jennings, and how do you like having your face on that, Charlie?

Someone joked the other day that, since I’m retired, she was surprised I wasn’t living on some Greek island, and, if everything were stable, I’d buy the idea. But cost of living isn’t stable, and, just as Arlo and Janis need to stay put, so do we all.

It’s like that old joke about the fellow who awakens from a decades-long coma and calls his bank to learn how his savings have grown, only to have the operator interrupt and ask him to deposit $2,000 for the next three minutes. And I realize younger readers won’t understand how savings could grow or the concept of a pay phone, but trust me.

And, as long as we’re contemplating the British pound, I mentioned the shellacking Liz Truss is getting from cartoonists, but here she is getting pummeled by a columnist instead and don’t you wish our newspapers had that kind of cojones?

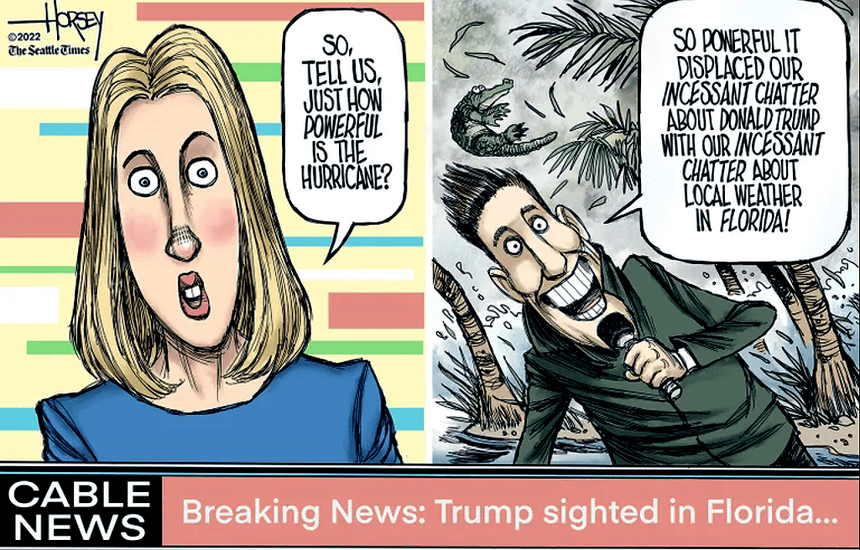

To segue to the topic of media, David Horsey tops this cartoon with a solid column on how broadcast media has become obsessed with over-covering a single story at a time.

He’s right, and I miss the old Headline News that would give you the top-of-the-news every half hour, rather than drop coverage of everything else to endlessly rehash their chosen Story of the Day.

People have asked why reporters stand out in the hurricane, but it’s their job, and there is value in letting viewers see how serious a storm is, just as there is value in having reporters at the front in wars, so long as they are reporting and not just showing off.

Journalism is serious business and the Reliable Sources newsletter included a good interview the other day on the topic of reporter safety in hurricanes.

Juxtaposition of the Day (Sports Division)

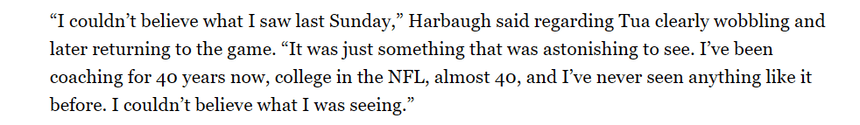

Football viewers were treated to a horror show this past week, as Miami Dolphins Quarterback Tua Tagovailoa sustained a serious injury in Sunday’s game against Buffalo, staggering and falling on the field, but was then allowed back into that game.

Eight days later, he suffered another head injury that left him unable to leave the field under his own power, and he is not expected to play this weekend.

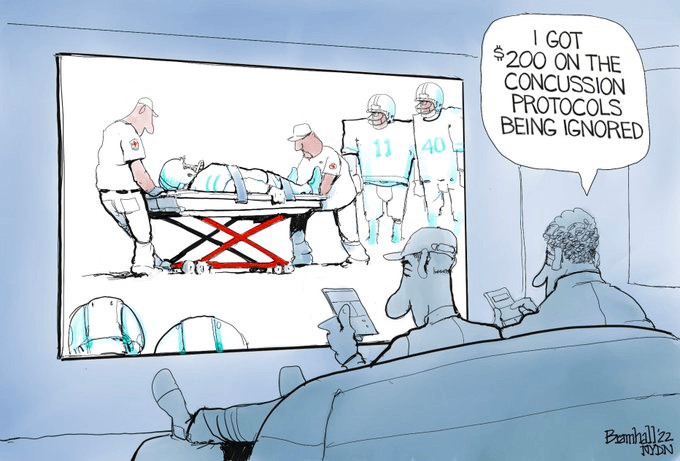

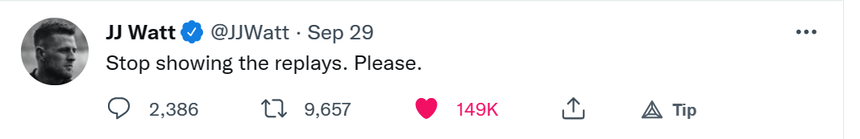

Arizona Cardinals Defensive End JJ Watt, who has delivered more than his share of hits on quarterbacks, spoke, as you can see, for thousands of fans in begging the TV network (Amazon Prime) to quit replaying Tagovailoa’s injury in that Monday night game, and Bramhall echoes his condemnation of the Roman Coliseum aspect of the coverage.

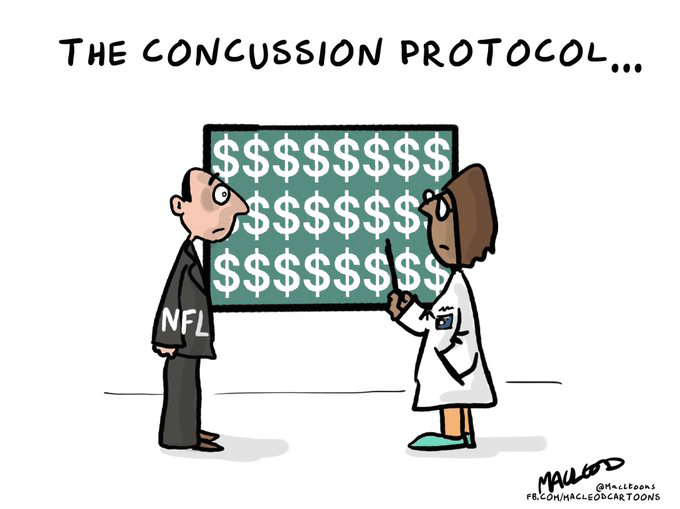

The NFL has instituted several rule changes, equipment innovations and injury protocols to reduce the head injuries that too often result in serious, permanent and fatal brain damage, but, as Dr. Macleod suggests, there are still ratings to consider and the dregs of the old school “Get out there and shake it off” tough guy attitude.

The players union has taken the lead, firing the “unaffiliated neurotrauma consultant” who, under league rules and the collective bargaining agreement, is tasked with evaluating concussions on the sideline.

There certainly needs to be more response. As that NBC story reported, Baltimore Ravens Coach John Harbaugh was horrified by the fact the Tagovailoa was allowed to return to the first game, never mind being cleared to play in the next:

It’s a story as old as the game, but Watt and Harbaugh — two of the more thoughtful men in the league — believe the game can be played with a modicum of safety, if ethics and rules are respected.

The question is, does the League Office believe it?

Or this?

Comments 12

Comments are closed.