CSotD: A Diller, A Dollar

Skip to comments

Biden’s decision to cancel a portion of student loan debt is top of the news, and Kevin Siers makes the point that, while it’s not a cure-all, lot of people wanted it to happen.

It’s a sign of the times that doing something a lot of people wanted you to do carries a tinge of partisan self-interest, but here we are. It’s a reverse-twist on the old joke that, if Obama or Biden recommended that people breathe, a lot of Republicans would suffocate, and that’s a large part of the negative response from their side of the aisle.

Juxtaposition of the Day

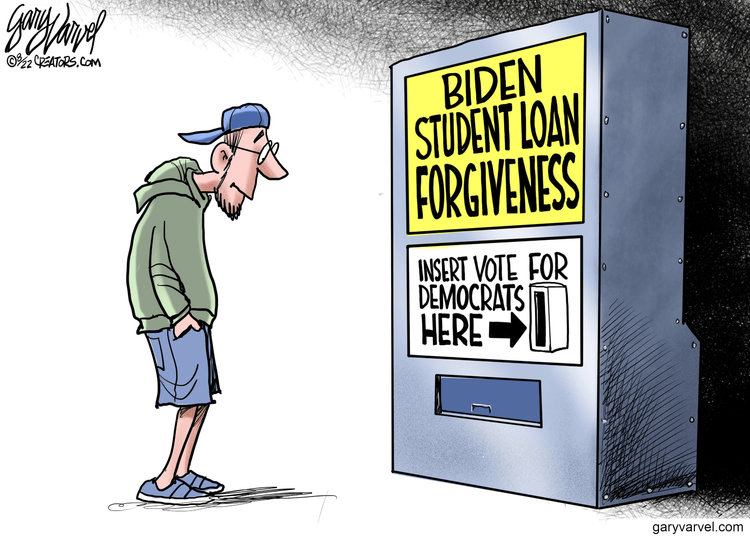

There are several variations on the Class Warfare take, but these two span the width: Varvel agrees with Siers that it will make Democrats more attractive to college-educated voters, but insists that people who go to college are elitist goofballs.

Gorrell depicts people who didn’t go to college as stupid-looking, which seems like an insult to his own demographic, but victimhood is key to conservative politics, so the message is that the elites are exploiting us again, and that only a stupid sucker would stand for such a thing.

Class issues around college are nothing new, and here’s something I wrote on the topic five years ago:

College was once the province of the elite, and collegiate novels — starting in 1861 with “Tom Brown at Oxford,” which was copied a half century later in “Stover at Yale” — focused on rich, spoiled spendthrifts who contrasted with a small group of serious students who had genuinely shown up to learn.

One of the things I noted, in going from being a student at a private college to living among students at the University of Colorado, was that there were far more students at CU who were blue collar, minorities and Vietnam vets, which I ascribe to a practical need to get the sheepskin and get to work.

Juxtaposition of the Day #2

Anderson points out, before we all get too carried away, that the forgiveness being offered is far from complete, and the person who piled up $50,000 in debt to pursue a degree in art history is still going to have to deal with most of it, albeit with some grace in that payments will be tempered by the art historian’s pay at Wendy’s.

That benefit aside, there are a lot of limitations and restrictions. Here’s a guide to the Good News/Bad News involved.

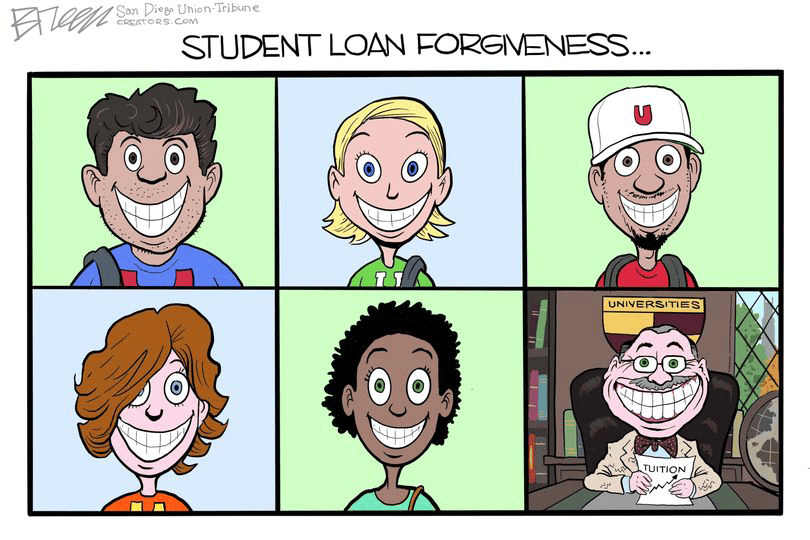

Bok is somewhat off the mark, because students aren’t richer, exactly, and would be foolish indeed to think they now have “free money” to throw around.

On the other hand, there is an element of foolishness involved in the ways schools have added fripperies like climbing walls to attract students, and both Bok and Breen have a valid point that this move doesn’t address the rising cost of college.

We used to say “War is good business; Invest your son,” but college has since then become good business. The interactive form of this graph will let you pin it down more precisely, but the basic fact is that, while the draft made going to college attractive for guys during Vietnam (half our specific demographic served anyway), the growth in enrollment since then has been mirrored by a growing refusal by employers to interview those without diplomas for professional positions.

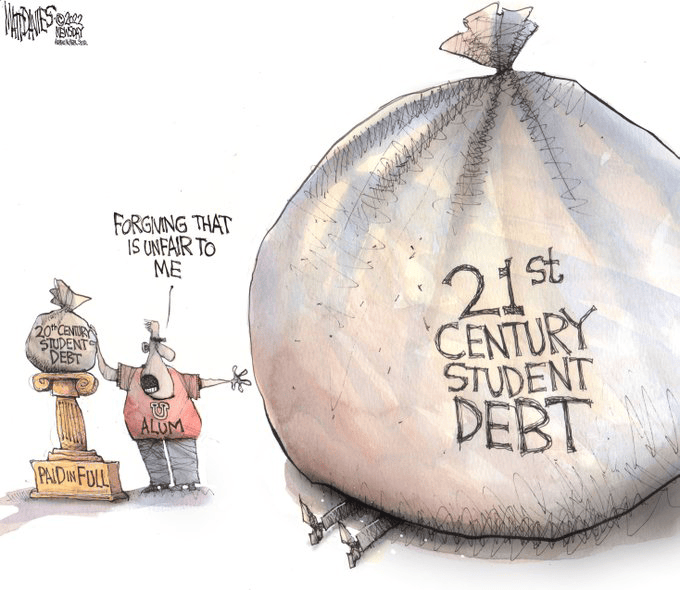

Matt Davies rightly notes the contrast between those who went to college a generation or two ago and those paying for those rock-climbing walls and exotic food courts today.

This Grumpy Old Man will note that my freshman year dorm not only had no cooking or laundry facilities, but also no carpets or drapes.

More to the point, as I wrote nearly 30 years ago

Today, the median per-capita income is $35,384, but median total cost per year at a private university is $54,501, while public college will still set you back about $25,707. (And, BTW, that house now has a Zillow estimated value of $500,600.)

Point being that, first, if a full third of young people are graduating from college, it’s no longer an “elitist” matter, and, second, chipping 10 or 20 grand off the bill is a good gesture, but it’s hardly a cure for what ails us.

What ails us is that we’re grudgingly willing to pay for K-12 education, but not nearly as committed to workforce development in the final four years.

Matt Wuerker (Politico) is hardly the only person to note that relieving the pressure on indebted students is being criticized by people who have had no problem with legislation relieving the pressure on themselves, and who, by the way, still believe — against all historical evidence — in the theory of trickle-down economics, otherwise known as “A rising tide lifts all yachts.”

In order to understand the economic impact of Biden’s loan forgiveness, you need to realize that those who benefit will do so not by a huge cash infusion but by having less of their paychecks go to debt repayment, which will free that money to go into the economy in another form of trickle.

Will it cost the government? Like a lot of those questions, it depends on who does the math and what answer they’re being urged to find.

And it has been noted by others that “How are you going to pay for that?” is rarely asked about the Defense budget or tax cuts for plutocrats who don’t pay their fair share to begin with.

Ted Rall (AMS) summarized the real objection in this April cartoon: I went barefoot, so why should my neighbor’s child have shoes?

And, while opponents have found people to complain that they paid off college and so nobody else should get help, social media has been flooded with people saying they paid off their loans and are happy to see others get the breaks they never had.

As well as things like this Twitter thread noting the number of complainants who, having taken advantage of the system to score dubious PPP loans in the first place, then ducked out on them at government expense. (The White House also noticed.)

Meanwhile, this PSA is part of the mix, given that some state legislators seem to also question whether children should be fed.

Comments 6

Comments are closed.